sales tax in concord california

State sales and use taxes provide. The average cumulative sales tax rate in Concord California is 975.

1866 Robin Ln 1 Concord Ca 94520 Redfin

Concord in California has a tax rate of 875 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Concord totaling.

/https://s3.amazonaws.com/lmbucket0/media/business/willow-pass-fry-blvd-8931-1-czxFjnl-ABosaabCxGvp2rb9zkFLcACa0eKNzjEezPs.8fc9fae5b484.jpg)

. The average Sales Tax Accountant salary in Concord CA is 56738 as of August 29 2022 but the salary range typically falls between 49786 and 62900. It was approved. Concord Sales Tax Rates for 2022.

Salary ranges can vary widely. The minimum combined 2022 sales tax rate for Concord California is. This is the total of state county and city sales tax rates.

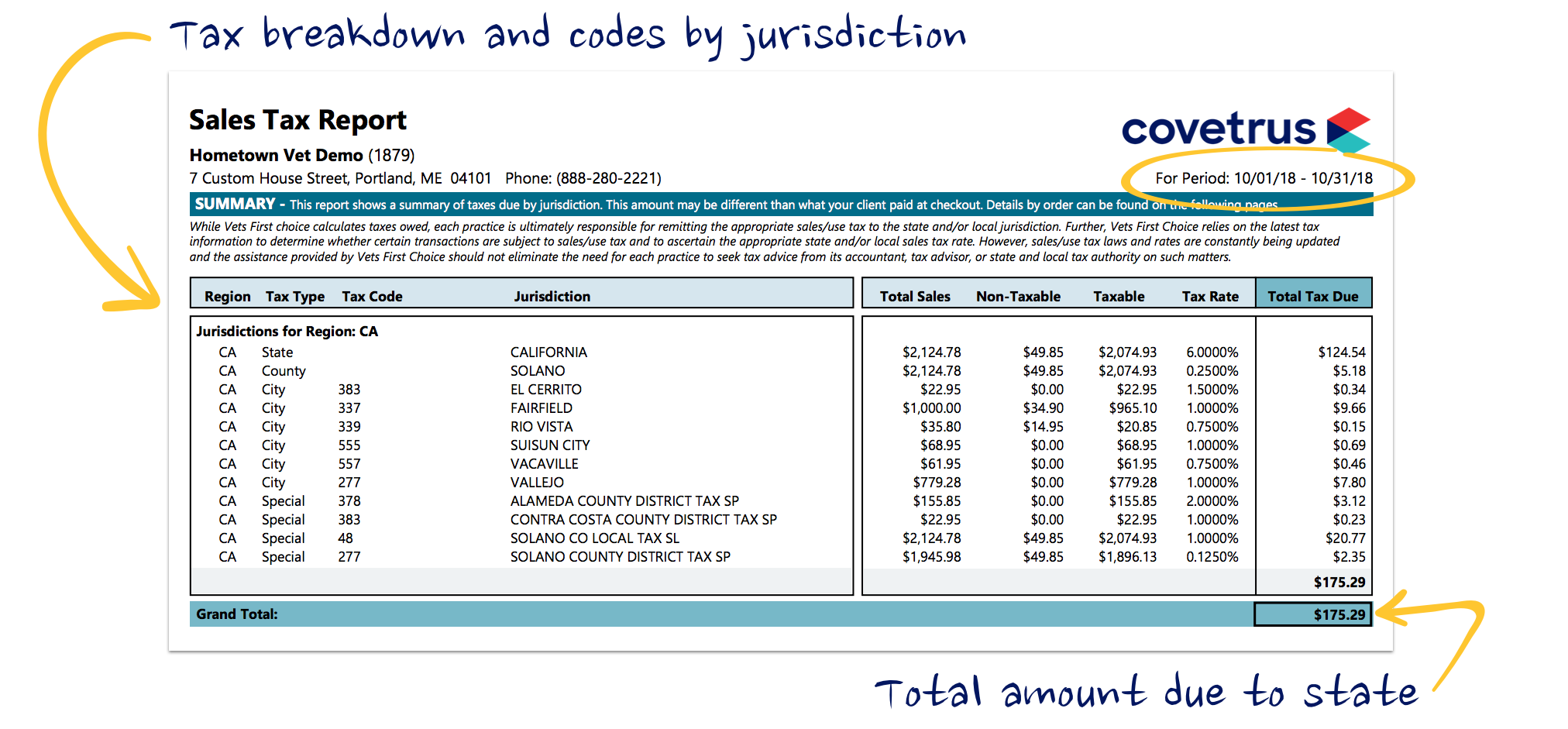

CALIFORNIA DEPARTMENT OF TAX AND FEE. The latest sales tax rates for cities starting with C in California CA state. The 975 sales tax rate in Concord consists of 6 California state sales tax 025 Contra Costa County sales tax 1 Concord tax and 25 Special tax.

By Kristine Cummings August 15 2022 August 15 2022. Find a Sales and Use Tax Rate. How Much Is Sales Tax In Concord Ca.

California Sales Tax. 2020 rates included for use while preparing your income. Sales Tax in Concord CA.

The sales and use tax rate in a specific California location has three parts. What is the sales tax rate in Concord California. Rates include state county and city taxes.

The Concord California sales tax is 875 consisting of 600 California state sales tax and 275 Concord local sales taxesThe local sales tax consists of a 025 county sales tax a. While the State of California only charges a 6 sales tax theres also a state mandated 125 local rate bringing the minimum sales tax rate in the state up to 725. The friendly and professional atmosphere makes having your taxes done painless.

1788 rows California Department of Tax and Fee Administration Cities Counties and Tax Rates. City of Orinda 975. We found 3030 results for Sales Tax Consultants in or near Concord CAThey also appear in other related business categories including Taxes-Consultants Representatives Tax Return.

This tax does not all go to the state though. City of Concord 975. Concord Measure V was on the ballot as a referral in Concord on November 3 2020.

Type an address above and click Search to find the sales and use tax rate for that location. The state tax rate the local tax rate and any district tax rate that may be in effect. The true state sales tax in California is 6.

Concord is located within Contra Costa County. The minimum combined 2022 sales tax rate for Concord California is. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Concord CA.

Youll leave knowing your taxes well be prepared. Town of Moraga 975. City of Martinez 975.

The minimum sales tax in California is 725. Please ensure the address information you input is. City of Hercules 925.

For a list of your current and historical rates go to the California City County. City of El Cerrito 1025. A yes vote supported authorizing an extension and.

You can print a 975 sales tax table. The 975 sales tax rate in Concord consists of 6 California state sales tax 025 Contra Costa County sales tax 1 Concord tax and 25 Special tax. This includes the rates on the state county city and special levels.

3520 Hillsborough Dr Concord Ca 94520 Redfin

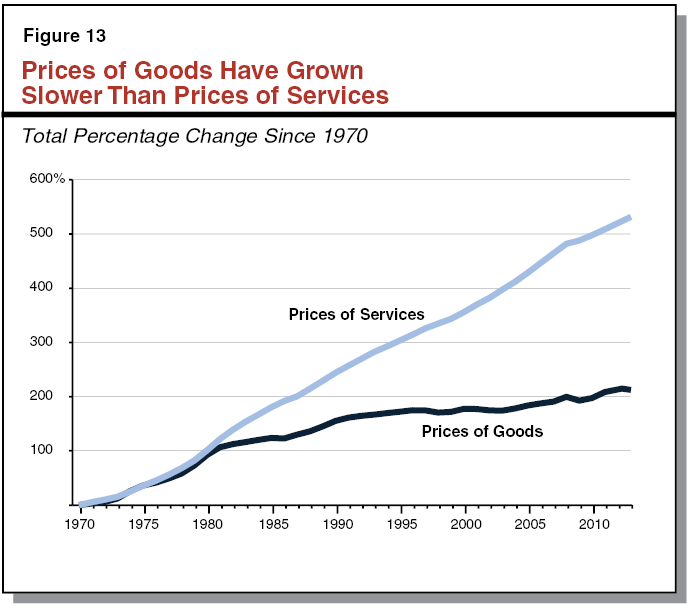

Understanding California S Sales Tax

4048 Kimberly Pl Concord Ca 94521 Redfin

Sales Gas Taxes Increasing In The Bay Area And California

134 S Magnolia Ave Unit 12b Anaheim Ca 92804 Realtor Com

Understanding California S Sales Tax

New Cars Trucks Suvs In Stock Concord Concord Mazda

Understanding California S Sales Tax

No April Fools Joke City Sales Tax Rises To 10 25 April 1 El Cerrito Ca Patch

Used Ford Taurus For Sale In Concord Ca Cargurus

Concord Ca Businesses For Sale Bizbuysell

Used Chrysler Pacifica Hybrid For Sale In Concord Ca Cargurus

2345 Fairfield Ave Concord Ca 94520 Mls 41010703 Zillow

Frescia Y Ramos Bellido Tax Specialist Notary Public Fyrb Tax Services Concord Ca

3243 Clayton Rd Concord Ca 94519 Redfin